Trucking services are the backbone of the Philippine logistics industry, handling the majority of freight movement across Luzon, Visayas, and Mindanao. The rise of trucking technology-enabled, from telematics to AI to EV trucks, has started to reshape the technology in industry’s costs, speed, safety, and environmental footprint.

For shippers in the Philippines, the question is no longer “Should we digitize?” but rather “How fast can we integrate these shifts?” The stakes are high: reduced diesel bills, higher uptime, lower accident risk, and compliance with local sustainability mandates. Large retailers in Metro Manila already report up to 8% fuel savings through advanced fleet systems driving eco-routing and intelligent cruise control. As EV charging builds out, regulatory enforcement tightens, and customs digitalization expands, the logistics industry is entering a transformative phase.

Technology in Industry: EV Trucks and Fleets Are Emerging

The Philippines is now at the early adoption stage of EV fleets, with landmark rollouts by global retailers and logistics leaders. According to the Department of Energy (DOE) , EVCS providers in the country grew from 92 accredited companies in October 2024 to 147 providers by May 2025, with more than 1,100 charging points nationwide (DOE Facebook; EV Industry News).

Several industry pioneers are pushing this transition:

- IKEA Philippines now deploys 39+ EV trucks for 100% electrified last-mile deliveries in Metro Manila (IKEA PH).

- Mober Logistics launched the Philippines’ first fully electric tractor head in February 2025 (Adobo Magazine).

- DHL Express deployed 25 new EVs nationwide in 2024, including 10 trucks, and committed to 60% electrification by 2030 (DHL Press).

These examples show that EVs aren’t just pilot projects anymore, they are becoming part of the everyday logistics, technology in industry.

Charging Build-Out and EVIDA Incentives

The Philippines is scaling charging infrastructure under the Electric Vehicle Industry Development Act (EVIDA, RA 11697) , which provides non-fiscal perks such as priority vehicle registration and unified charging rates. DOE also issued an EVCS fee unbundling advisory to promote transparent pricing for charging services.

DOE’s latest report shows accredited EVCS providers jumped from 92 in 2024 to 147 by mid-2025.

Where will high-power depot charging make sense first?

The first viable sites are NCR (Quezon City, Taguig) and CALABARZON industrial hubs (Cabuyao, Batangas), close to logistics depots and industrial zones. Central Luzon ports will be next.

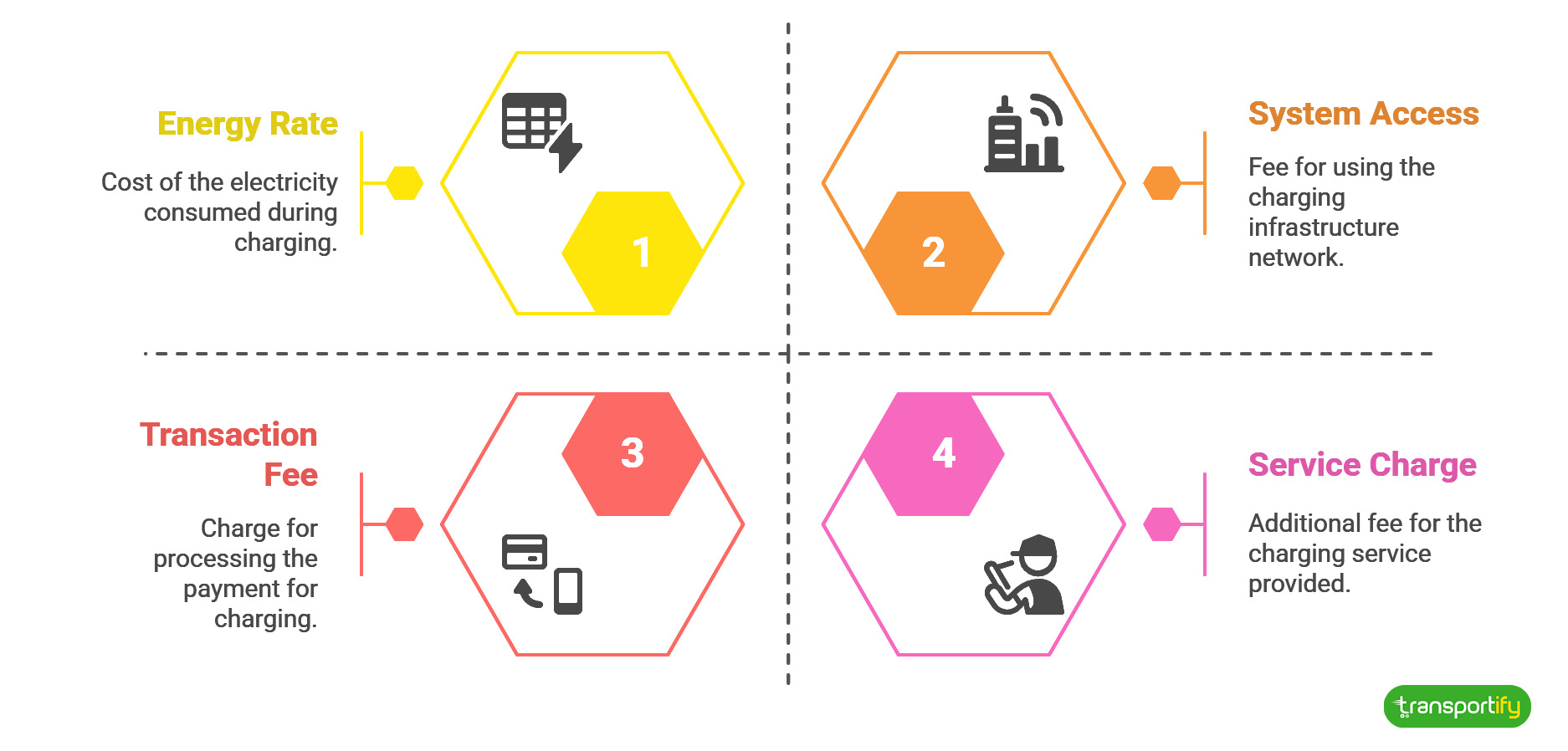

What is the current cost structure?

The DOE’s unbundled fee advisory outlines cost components: energy rate, system access, transaction fee, and service charge. Carriers need to evaluate depot charging economics vs. commercial EVCS to model their total cost of ownership before scaling.

Market and Efficiency Signals to Watch

The World Bank Logistics Performance Index (2023) scored the Philippines mid-tier across customs, infrastructure, and timeliness. Yet the domestic market is massive, valued between USD 19.16B to USD 55.65B in 2024, and projected to grow strongly through 2030).

Which tech levers move ₱/km most on NCR–Luzon?

- EV trucks reduce fuel volatility

- AI routing systems improve drop density

- Telematics + predictive maintenance cut downtime

Where are the biggest administrative time sinks?

Paper-based invoicing, customs clearance wait times, and data silos are the top sources, ripe for digitalization and API-based integration.

Cyber Risk for Trucking Technology in Philippines

Digital trucking also increases exposure. DICT reported monitoring ~2M cyber threats daily in October 2024, while blocking 5.4M malicious attempts across 32 government agencies in the same year.

PH’s National Computer Emergency Response Team (NCERT) logged 57,400 threats and 3,470 incidents from 2021–2023, with malware making up nearly 49% of cases.

What cyber controls should carriers apply?

- Multi-factor authentication (MFA)

- Endpoint Detection & Response (EDR)

- Daily backups and recovery drill testing

- Quarterly phishing simulations for staff

Are cyber-addenda appearing in PH contracts?

Yes. Recent logistics contracts specify cyber liability clauses and require compliance with insurance-backed IT security frameworksm, becoming a de facto standard in public sector bids and MNC shipper tenders.

From Fleet Modernization to Business Growth with Transportify

The trucking business in the Philippines is about to enter a new era when trucking requirements, electrification, and digitization are not only best practices but also necessary for competition. For entrepreneurs and operators, this means that running a trucking business today is no longer just about buying trucks, it’s about choosing the right partners, platforms, and technology in industry.

|

This aligns directly with what we outlined in Transportify’s guide on how to start a trucking business in the logistics industry: success depends on adapting quickly to changing customer expectations, regulations, and trucking technology. Transportify already enables thousands of fleet owners to digitize operations through:

Integrated telematics and route optimization

Transportify connects vehicle GPS data with smart order management, helping reduce fuel costs and optimize turnaround times.

Compliance-friendly systems

Operators can comply with DOTr, LTO, and BOC mandates by plugging into Transportify’s platform for tracking, visibility, and proof-of-delivery, avoiding costly manual reporting.

Green logistics readiness

With IKEA, DHL, and Mober proving EV viability, Transportify’s open platform can integrate mixed-fleet signals (diesel + EV) , allowing operators to gradually transition to cleaner trucks without disrupting service.

Cyber-resilient operations

In an era of increasing DICT-monitored cyber threats, Transportify shields its users with secure APIs, robust IT controls, and data privacy safeguards, giving shippers confidence over sensitive supply chain information.

For trucking business owners, the next step is clear: embrace connected logistics platforms like Transportify that already scale across Luzon, Visayas, and Mindanao, while preparing to plug into future-proof technologies like EV trucks, predictive telematics, and digital customs workflows.

The Takeaway for Trucking Entrepreneurs

If you are launching or scaling a trucking business in 2025, your playbook should mirror where the technology in industry is moving:

- Digitize first — connect your trucks, drivers, and deliveries with Transportify’s platform.

- Integrate compliance — align with RA 10916 (Speed Limiter), RA 8794 (Anti-Overloading), and E-TRACC tracking now.

- Pilot sustainable fleets — explore EV use-cases for Metro Manila and NCR–CALABARZON corridors.

- Leverage data as an asset — turn driver performance, telematics, and customs milestones into stronger negotiations with clients and insurers.

- Build resilience — invest in both road safety and cyber defenses to future-proof your fleet operations.

Philippine trucking is at an inflection point; EV adoption, telematics compliance, customs digitalization, and cybersecurity are converging to reshape costs and competitiveness. Shippers must prioritize trucking technology integration, safety investment, and regulatory alignment in their fleet sourcing strategies.

| or |

INSTANT QUOTE

INSTANT QUOTE

Chat

Chat